Novated Lease basics: The eco car LCT threshold explained in full

If you’re about to start your first novated lease, to take advantage of green car tax concessions for EVs and plug-in hybrids, then it's extremely important to get the price of your vehicle beneath the required threshold. Here’s how…

You’re a novated lease virgin ready to jump into an EV for the very first time because you want those federal government tax concessions for electric and plug-in vehicles.

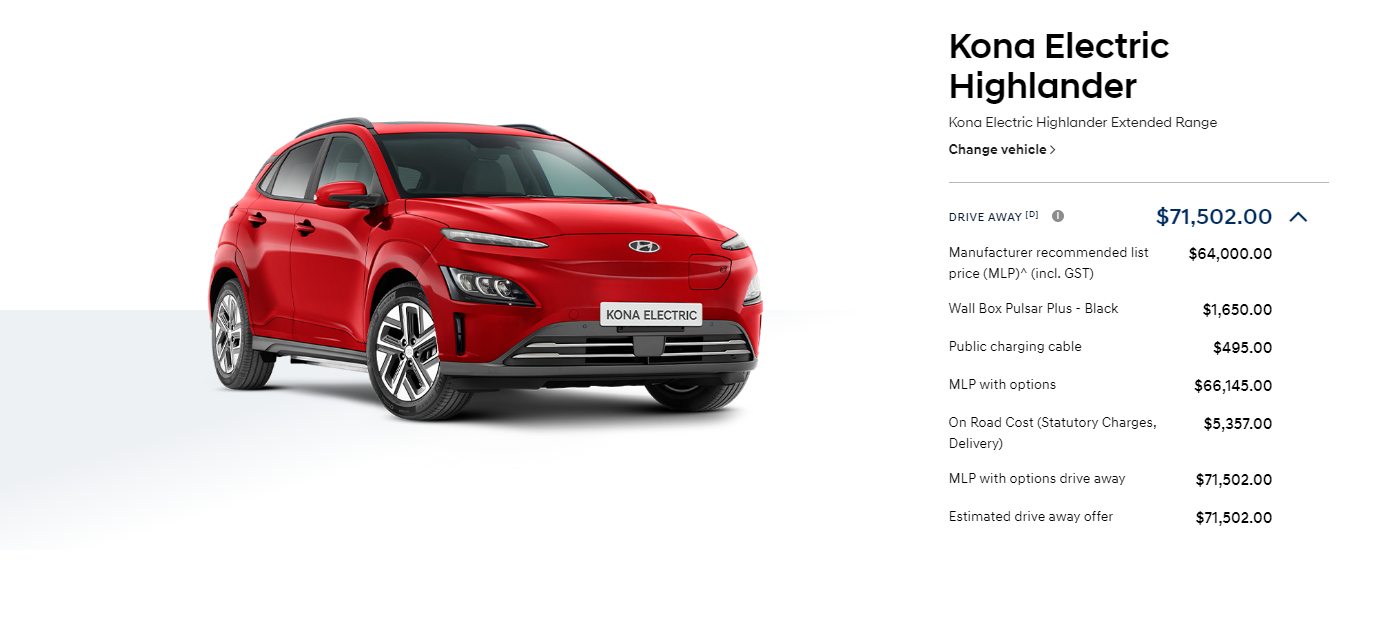

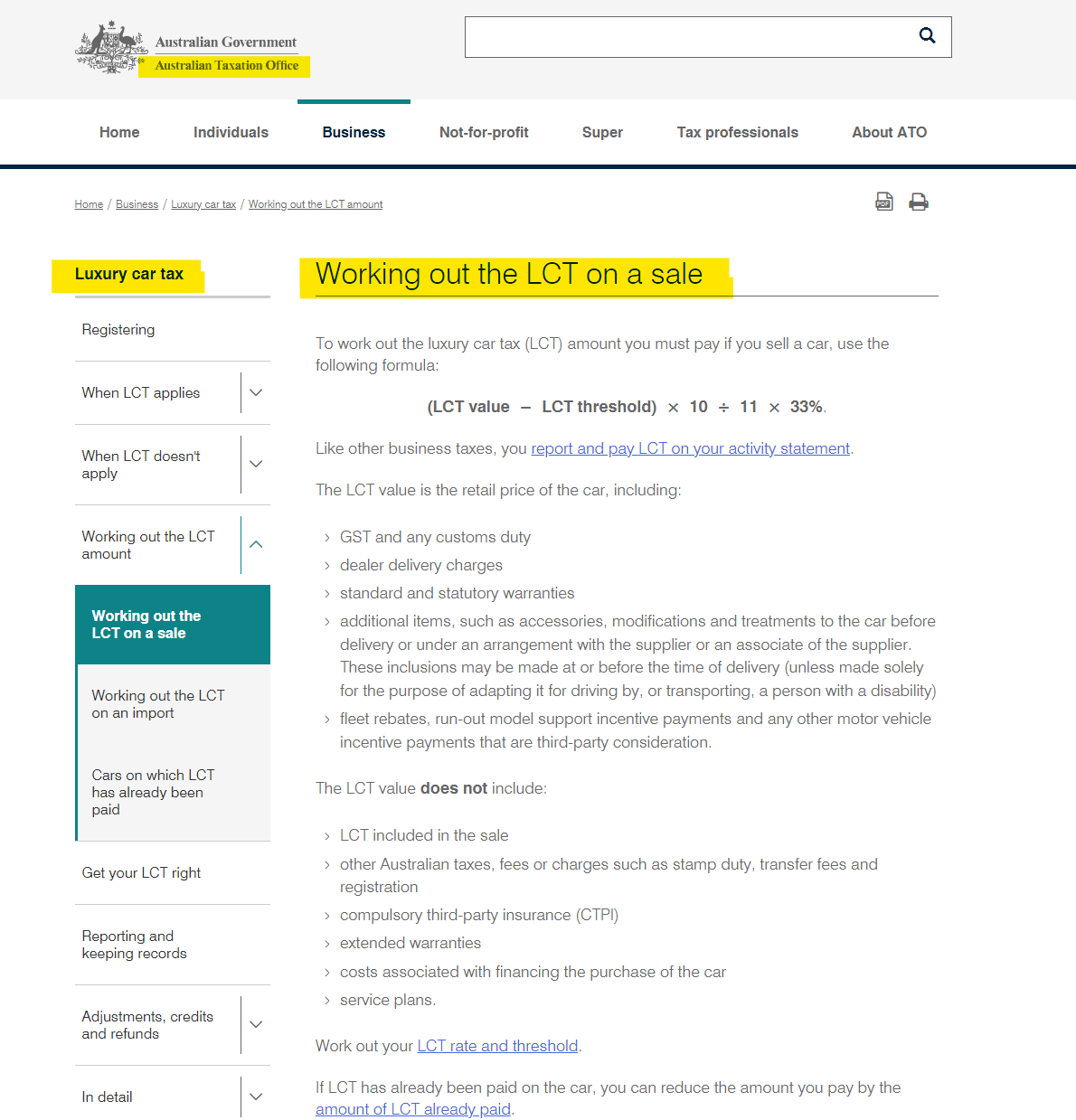

This means the price of that vehicle needs to be below the the luxury car tax threshold, which is $84,916 for the 2022-23 financial year. But the curly question is what's included in that price, and what's not? Is it the manufacturer's list price, or the driveway price? Is it exclusive of GST?

The correct answers are no, no and no - but if you're just one dollar over in your determination, then the tax office could easily make those tax concessions evaporate. It’s quite critical to get this right, so let’s do that now.

Novated leasing is a dead simple concept. The simple bit is: you don't pay the GST. This is a massive saving up front. What you're essentially doing is using your pre-tax salary to make the payments on your new car, and this means that some of the money that you would have otherwise just paid to the federal government in tax instead gets devoted to making the payments on the car. All good.

The problem, if there is one, is that there's a lot of complexity. The granular detail of novated leasing gets complex super fast. So let’s try to simplify it for you.

So you’re aware, if you want to qualify for the federal government's zero FBT incentive for eco cars, which would be battery-only electric vehicles and plug-in hybrids - but not conventional hybrids (the kind that you can't plug in) - if you want to qualify for that, it is absolutely essential you buy the correct type of vehicle.

Once again: fully-electric vehicles and plug-in hybrids only. NOT ordinary parallel or series hybrids. Check out my EV & PHEV buyer’s guide to clarify this and the benefits of these vehicles on offer.

According to the ATO, the $84,916 threshold includes the GST. So even though you will not pay the GST on a vehicle if you get a novated lease, the GST on that vehicle is included in the computation of the threshold.

It also includes customs duty which you might think of as the import tariff on the car. And this is an area where there's significant complexity as well, because we have free trade agreements with Japan, South Korea, Thailand, China and the USA. This means that there is no import duty on vehicles sourced from those countries.

Dealer delivery is also included and so is statutory and standard warranties for cars. The reason dealer delivery and the warranty situation is in place is this is to prevent dealers and car makers from fudging the books. If the dealer could charge you ten grand in dealer delivery and knock eight grand off the price of the car and thereby artificially lower the value for the computation of LCT, then that would be a fudge. That's why those two things are included in the determination of where you are relative to the luxury car tax threshold.

My AutoExpert AFFORDABLE ROADSIDE ASSISTANCE PACKAGE

If you’re sick of paying through the neck for roadside assistance I’ve teamed up with 24/7 to offer AutoExpert readers nationwide roadside assistance from just $69 annually, plus there’s NO JOINING FEE

Full details here >>

AutoExpert DISCOUNT OLIGHT TORCHES

These flashlights are awesome. I carry the Olight Warrior Mini 2 every day - it’s tiny, robust, and super useful in the field or in the workshop. Olight is a terrific supporter of AutoExpert.

Use the code AEJC to get a 12% discount >>

Generators suck! Go off-grid with AutoExpert BLUETTI PORTABLE POWER STATIONS

Need mobile, reliable power? If you’re camping, boating, caravanning or building a dirty big shed in the back paddock, and you need to run a refrigerator, lights, air conditioner, cooking, and/or a bunch of tools - Bluetti has a clean, tidy, robust solution…

Get your AutoExpert free shipping discount here: https://bit.ly/3n62heK

Further decoding the FBT matrix

Accessories are also included in the price threshold for FBT incentives.

Now, accessories include things like tow bars and you have to be very careful if you're getting close to the limit because it's easy to keep ticking the boxes. Adding a tow bar, the genuine saxophone holder, the gun rack - it all adds to the possibility of blowing the threshold if you're already close with the base car.

Modifications are also included, so if, for example, you get the dealer to fit you an aftermarket dashcam and that goes on the price of the new vehicle, then it's included for the determination of where you are on the threshold. The only time modifications are not included is if that modification is to facilitate driving of that vehicle by a disabled person. So disability modifications are exempt, but all other modifications are included in the price.

Other modifications include treatments like paint protection, window tinting and rust proofing - even though modern cars don't need rust proofing, and they certainly don't need paint protection, and window tinting can be done at a fraction of the cost by any professional window tinting business.

But plenty of people tick those boxes. If you keep ticking them, it jams the luxury value price up closer and closer to the threshold which you must not step over by even one dollar.

The final thing that is included is fleet rebates, run out model support incentive payments “any other motor vehicle incentive payments that are a third-party consideration’.

There are a few things that are not included in the threshold, however, and the ATO details those as well.

It does not include other Australian taxes, so the GST is in and the import tariff (if it is paid at all) is in, but other Australian taxes are not included, such as:

Registration

Transfer fees

Stamp Duty

Number plate fees

Compulsory third party insurance

…these are not included.

Extended warranties - which you should never buy because they're just a waste of money and mean nothing in context of Australian Consumer Law anyway - they’re not included.

Costs associated with financing the car are not included. So presumably that means loan application fees and other finance of this nature not included.

Service plans, which you can sign up for in advance and are worth a couple of thousand bucks, all bundled up with the car - it's not included in the price and is not going to be part of the luxury car tax determination.

Let’s two two quick examples:

The Hyundai Ioniq 5 in NSW, according to data provided by Redbook.com.au, is $85,603 driveaway. You might therefore think that's over the threshold, but you’re wrong because if you take away the rego, stamp duty, the CTP and the number plate fee which according to RedBook totals $4214 - you're back to roughly $81,400 and you’re comfortably inside the threshold for Ioniq 5 Techniq - even though when you look at the price online using their configurator the driveaway price calculator suggests it’ll be over the value. But in fact it's not.

With the Ioniq 5 Techniq however, using the online configurator for driveaway price calculation, if you go adding the $549 at-home 15 amp power brick cable to plug into your garage outlet to give you roughly 50 per cent more charging capacity than the standard cable, that’s going to up the purchase price. Then, if you add a $1490 genuine towbar and then you tick the box for window tinting and paint protection and if you get the dealer to fit that dashcam - you’re quickly going to be over the threshold.

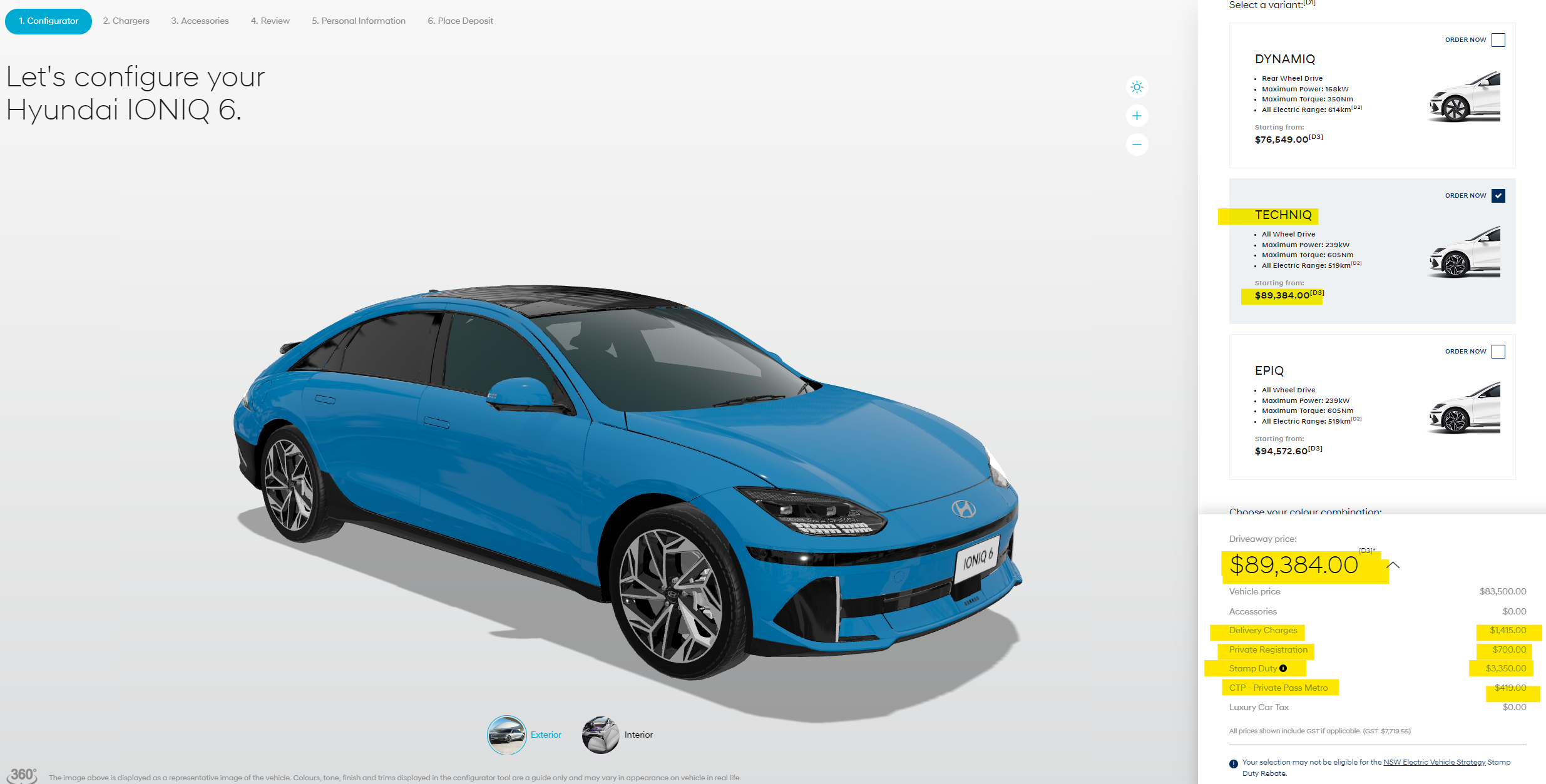

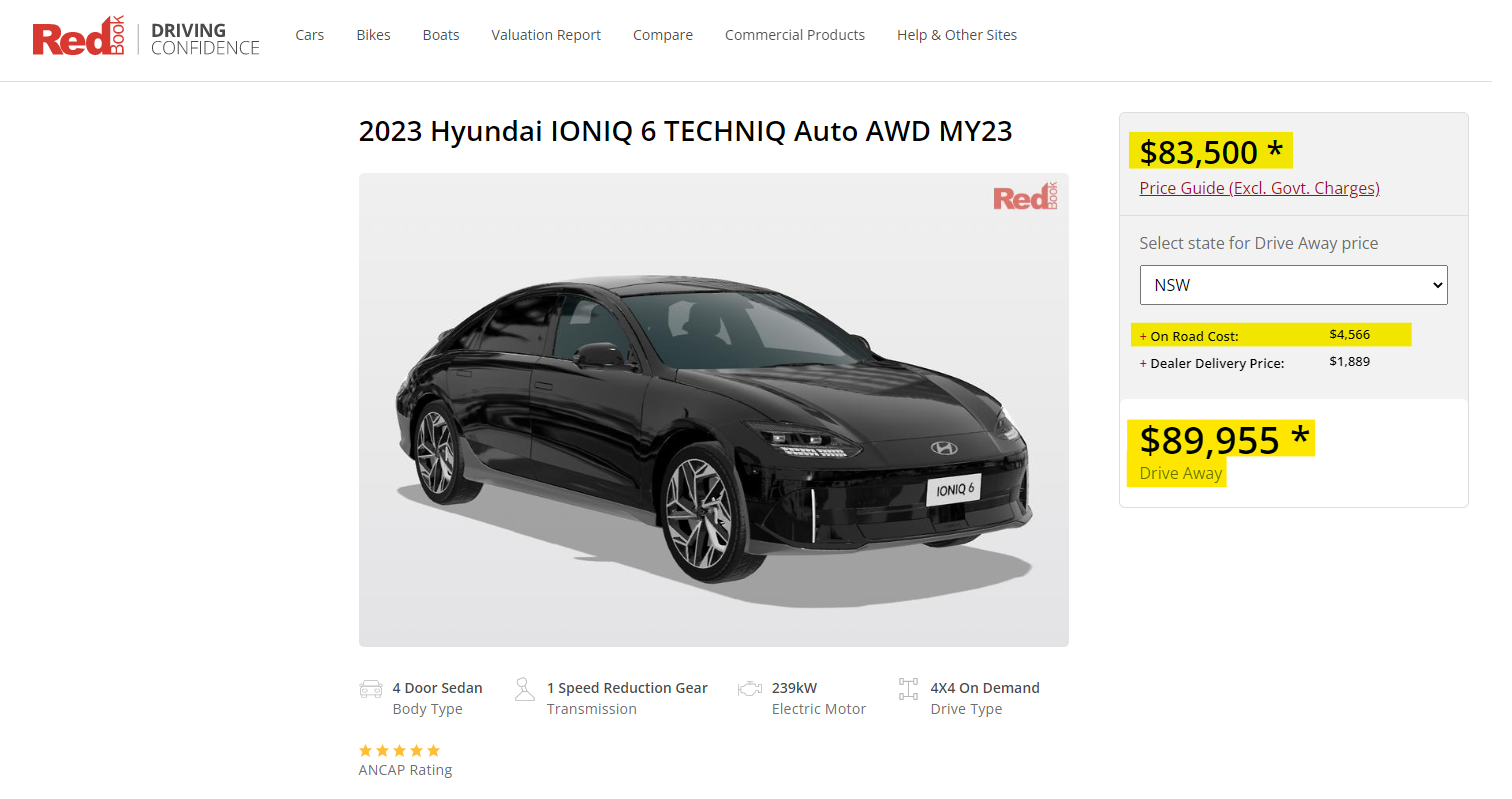

Compare that with Hyundai’s Ioniq 6 EV mid-level variant called ‘Techniq’, which is essentially the same powertrain in a slightly different body. Driveaway in New South Wales, it’s $89,955 according to Redbook once again. If you take away the registration, the stamp duty, the CTP and the number plate fee of $4566 - you're at roughly $85,400 - which is over the threshold and unacceptable if you want to capitalise on those massive FBT savings. You can't sidestep the GST on the car either, if you go for that base car, and you'll blow the limit by less than $500.

Even one dollar over means you will not qualify, so this is why you've got to be so careful. What I'd say is that in practice, registration and all of those statutory charges, they vary from state to state, so I can't give you a definitive answer on exactly what the price point is that you must stay below.

Here’s my definitive breakdown on Every EV & PHEV eligible for zero fringe benefits tax in Australia today >> to help you find the right EV under the threshold and eligible for the FBT exemption.

Try my Ultimate Electric Vehicle and Plug-In Hybrid Buyer's Guide >> to help you find a winner EV or PHEV and save thousands.

But what you've got to do in practice is exactly this pricing exercise that I've just done with you. The ballpark is that if you're under about $89,000 in total driveaway pricing, inclusive of GST, you're going to be close to the threshold - but it's probably possible.

However, in this environment I would suggest in the strongest possible terms that you measure twice and cut once, because if you make a one dollar mistake here, you could blow tens of thousands of dollars of potential savings and be up for the payment of all of those FBT and GST charges that you were absolutely not expecting but which you've signed up for because you've signed the loan contract for the car. At that point, you're committed.

This is just a horrible mistake to make, so if you really need guidance on all of this, I would strongly suggest bouncing all of the numbers off your accountant or some other properly qualified financial advisor before you step just one dollar over the line and watch all of those benefits just go up in flames - metaphorically.