Car Loan Calculator: Easy Car Loan Comparison Strategy

How to pick the cheapest car loan?

(Hint: It might not be the one with the lowest interest rate.)

If you’re buying a new car, you’ll probably also need car finance. Here's an easy car loan comparison.

You're actually conducting two transactions at this point: buying the new car, and buying car finance. (Three transactions, if you’re trading your old car in.)

If you’re focussing on buying a new car, you could be setting yourself up for a monumental ‘fail’ on the car loan - and that could cost you thousands.

Choosing the wrong car finance probably feels a lot like this...

New car buyers don’t think about the car loan details nearly enough. You should do this basic car loan comparison every time you shop for car finance. It's dead easy to do, it tells you unequivocally which car finance deal(s) are the most - and least - affordable, and taking a small amount of time to do it could easily save you thousands of dollars over the period of the loan contract.

Realise that when someone tries to sell you a car loan they will try to get you to decide on that car finance deal quickly, based on very few facts, and preferably no analysis. Like: Here’s the car loan. Check that great interest rate. Sign right here.

This process exploits a psychological piece of human frailty called 'thin slicing' (Google it). What an excellent way to rip yourself off.

Here’s a typical question:

“Toot Toot Car Loans seems to be offering deals around 6%.

Have you had any viewers give their advice on these guys?” - Jeff

Snapshot from NAB's car loan page online. Obviously nobody told the big bank that interest rates were at record lows...

Straight away, Jeff is sniffing the bait on that car finance hook - six per cent. Six per cent for a car loan sounds pretty good - especially if you’ve just been to the bank and they offered you a car loan at 14 per cent...

Here’s a critical question: Is it worth Jeff jamming the hook in his mouth, right now? Or should he swim around a bit more and peruse the car finance menu? How does anyone even make an educated call on which car loan is the right one?

You need to realise that none of the glossy documentation is designed to give you the car finance facts. It’s designed to sell you a car loan. They’re different agendas. It’s not in a car loan lender’s best interest to provide you with easily digestible information that allows you to compare this car finance deal with alternatives - they want you to buy, now.

Been offered one of those outrageous zero per cent car finance deals? Learn why zero per cent car finance is a rip-off here >>

Types of Car Finance

The first thing you need to do is decide what type of car finance you want: is it a personal car loan, a secured car loan, unsecured, a car lease, a chattel mortgage or a novated lease?

These forms of car finance are all very different financial instruments, and the right one for you depends exclusively on your financial affairs. Some are better suited to self-employed people, some for salaried employees, some for those with high levels of business use attached to the vehicle, and some for those who use the vehicle exclusively for personal use.

You need professional advice here - so put a visit to your accountant in your diary before you start shopping for finance.

Need to Know

When you’ve got that sorted, you can go on the hunt for the right kind of car loan. You also need to know the term of the car loan (that’s the duration). You need to know the amount you’re borrowing, and the balloon or residual payment at the end - if there is one.

All the car loans you get quotes on need to be the same in those three respects - term, amount and balloon. If they’re not, you’re not going to be comparing apples with apples.

So, you get a bunch of different car loans in front of you - different rates, different fees, different payments, different terms and conditions - but the same amount, term and balloon. How do you pick the best one? People often look at only that one factor. Like Jeff. He’s eyeing off the interest rate. But sometimes people focus on a slim monthly repayment as well.

Getting this right, and comparing car loans properly is a bit more complicated than any fixation on rate or payment. Sadly, you will need to engage your cerebral cortex, and crunch some Hindu-Arabic, but it’s not that hard. A politician could probably do this. With help. So: If you do it right, you could save substantial cash. But you cannot do this sitting across from the finance guy at the dealership - you need to take your time. Smart car finance and speed dating are not in the same temporal ballpark.

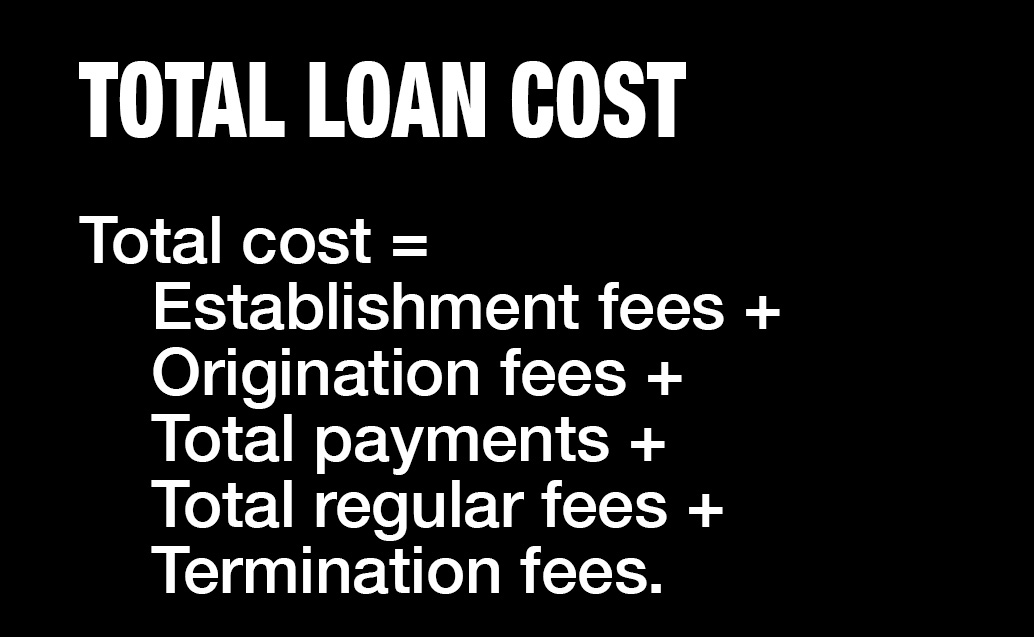

Forget the rate. Forget the payment. The only thing that matters is: How much is any car loan really going to cost you, in total? Let’s say you’ve got four different car loans on the table in front of you – all for the same amount, same term, same balloon. The only logical way to compare them is to add up the total amount payable by you over the whole term of the car loan. Total amount of cash being sucked out of your account - that’s what matters.

How To: Easy Car Loan Comparison

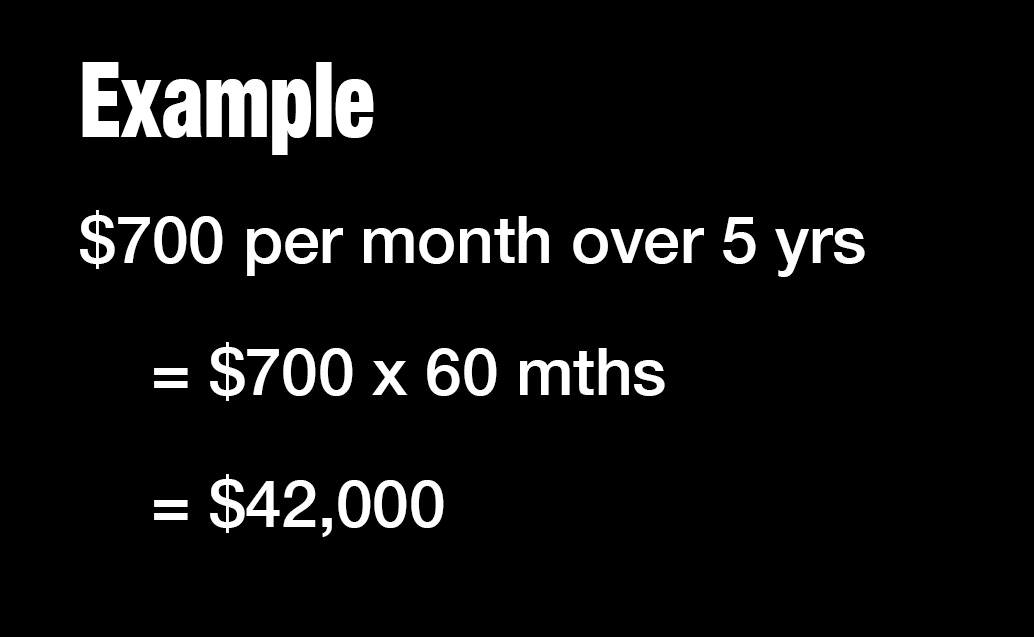

Crank up your trusty spreadsheet, or do it the steam-powered way, with a calculator and paper. Start with the loan establishment fee, if there is one, and add any broker or dealer origination fees. Then, you take the regular payment (it can be weekly, fortnightly or monthly - whatever) and you multiply that by the total number of payments. So - if it’s $700 even a month for five years, it’s $700 times 60 months, totalling $42,000. And you need to add any regular charges, like a monthly account keeping fee, to those regular payments, before you multiply. If there’s a pay-out fee at the end, you need to put that in as well.

The total of all these entries - establishment fees, termination fees and regular payments - tells you instantly which car loan is the cheapest. It’s the only real barometer of what’s a cheap car loan and what’s expensive.

Fees and charges have a huge impact on what a loan really costs. You could easily be on the cusp of wrapping your lips around a hook with a nice, juicy 6 per cent interest rate on it, but after factoring in the total cost, that car loan might not be as tasty as a low-fee car loan being offered at a higher notional interest rate like eight per cent, or something.

Warning: In-house Dealership Finance is Generally Expensive

Remember to avoid conducting all three financial transactions (right) under the one roof at the dealership. If you do, it exposes you to the risk that the dealership will leverage one or more transaction against the others. Don’t just go to the dealer, talk to the in-house car finance guy, nod at the interest rate (or the repayment) and sign on the line. You could easily be shooting yourself in the foot financially if you do that.

There are significant commissions being paid to dealerships who get the in-house car finance across the line. I’ve been a consultant to the car industry. I’ve been to dealer conferences, where there’s a standing ovation and a hefty cheque for the dealership with the most in-house finance conversions. Ultimately, you’re the one paying those fees, and that often makes dealership finance very expensive indeed. They’re not selling it to you because it’s a good deal for you.

Early Repayment Penalty

The other thing to consider is any early repayment penalty - if there is one. Typically, car loans with low setup costs have reasonably heavy fees for early repayment. So you need to watch out for that. But I guess that doesn’t really matter if you’re confident you’ll be going all the way to the full term with that car loan. So, you need to assess your own stability if there’s a hefty early termination payment in your loan contract.

Risky Business?

Finally, you need to make sure you qualify for the cheapest car loan you’ve found. Lenders will all do a risk assessment on you - it’s why they ask all those pesky questions. They do go into some detail. And if they decide you’re a comparatively risky financial proposition, according to them, car finance for you gets more expensive. The cheapest car loans always go to the most stable clients with good credit ratings, who have plenty of asset backing.

Still, I’d be telling the bank to shove it, above nine or 10 per cent. Send me a message and I’ll help you get a bunch of quality loans in front of you, from reputable Australian lenders. Doing that is dead easy, it’s quick, and there’s no obligation.

Got Bad Credit?

Don’t stress about it completely if you’ve got a bad credit history - there are affordable car finance solutions for you if you have a poor credit rating. Bad credit car loans from reputable car financiers is available - provided you meet some sensible criteria.

Contact me to learn more about specialist bad credit car finance. Click here >>

Leave a comment below to let me know what you think.